The pandemic has played an important role in bringing to light the social and economic importance of the Sub-Saharan Africa digital landscape. Despite the region’s telecommunications sector taking the challenge head-on by ensuring that personal and business connections are maintained, approximately 800 million people in Sub-Saharan Africa still remain in the dark.

This challenge calls for mobile service providers, governments, and policymakers to bridge the gap—implementing policies that increase connectivity access and driving investments towards a concrete, resilient digital infrastructure. These forward-looking plans have to take into account the region’s population of almost 800 million people and consider a fair deployment of mobile infrastructure throughout the vast Sub-Saharan Africa network.

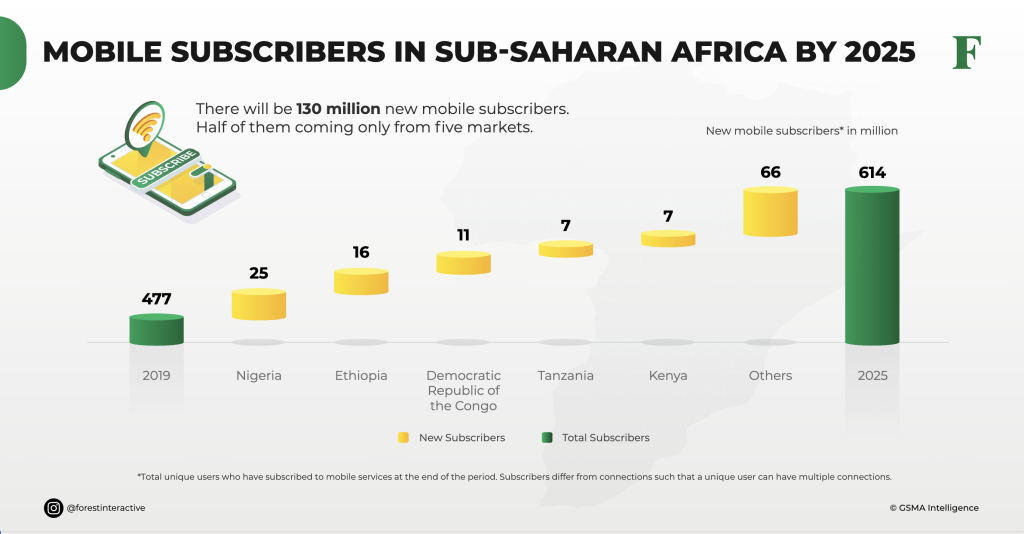

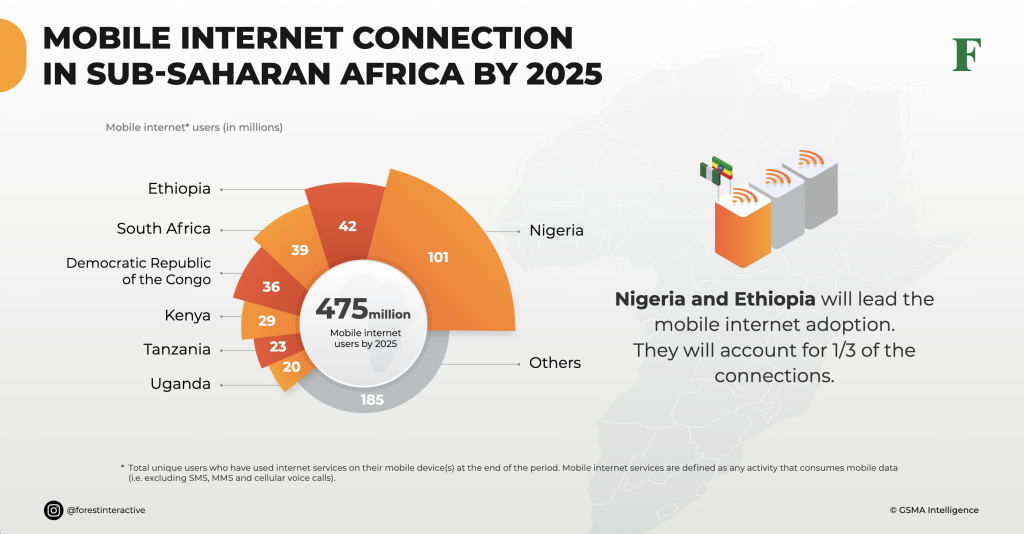

According to the GSMA’s Mobile Economy Sub-Saharan Africa 2020 report, 45% of the region’s population (477 million) had mobile service subscriptions by the end of 2019. The Sub-Saharan African mobile marketplace will go through several changes; by 2025, there are expected to be 614 million connections and a 65% subscriber penetration rate. Half of the new mobile subscribers will be spread among five markets: Nigeria, Ethiopia, Democratic Republic of the Congo, Tanzania, and Kenya.

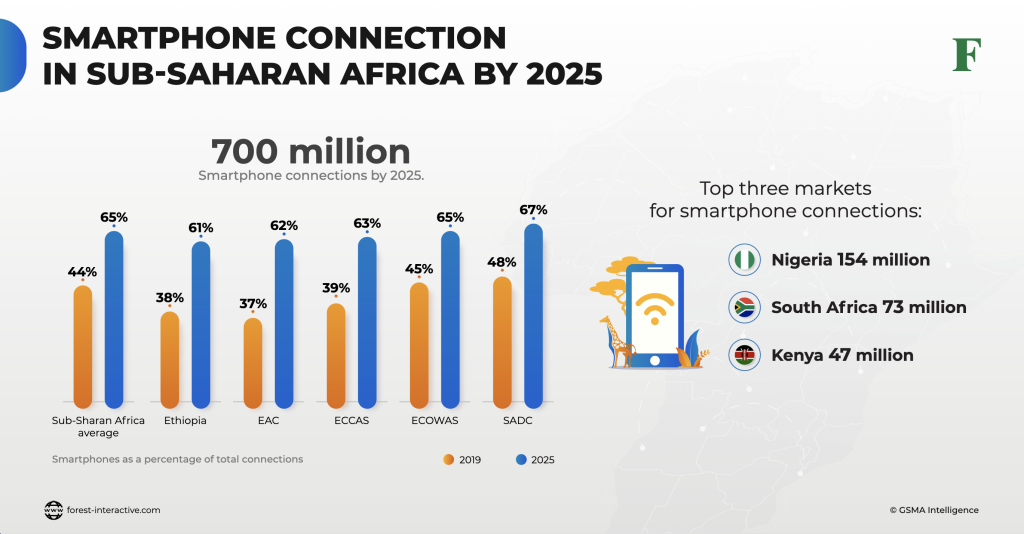

With an estimation of about 700 million smartphone connections in Sub-Saharan Africa by 2025, the top three major players for smartphone connections are Nigeria (154 million connections), South Africa (73 million connections), and Kenya (47 million connections).

Additionally, due to the rapid rise of smartphone adoption in the region, mobile operators will invest USD52 billion in the rollout of infrastructure between 2019 and 2025. The rapid adoption of smartphones has also catalyzed the popularity of smartphone financing models. This will play a vital part in the expected 65% adoption rate and increased mobile sector revenue by 2025.

Olatunji Kolade, Marketing & Business Development Manager of Nigeria at Forest Interactive, said this presents a positive outlook for the mobile economy.

“The post-COVID-19 economy has created many new jobs and a huge demand for e-commerce, online training courses on how to use online portals to provide services to clients, as well as huge platforms for religious programs and medical and education-related services.”

Having played a major role in improving productivity and stimulating economic growth back in 2019 by providing 3.8 million jobs, directly and indirectly, which resulted in the public funding of 17 billion through taxation, the mobile economy in Sub-Saharan Africa will contribute USD184 billion to the economy in 2024.

Meanwhile, as the 5G rollout gains momentum in other parts of the world, only South Africa has access to 5G services while other African countries such as Kenya, Nigeria, Uganda, and Gabon have conducted trials. Despite the rollouts and trials, 3G and 4G remain the dominant networks in the SSA region.

Another key trend is the disruption witnessed in the media and entertainment sector during the pandemic, which saw an increase in smartphone adoption. To capitalize on this trend, most mobile operators partnered with streaming platforms to serve the growing youth population. This is yet another major component that will contribute to the 700 million smartphone connections by 2025. Mobile financing schemes and low-cost phones will also contribute to this trend.

“Mobile technology is playing a big role in economy growth and opening the door to a whole new world of technology advancement and innovation,” Olatunji agrees. “This will help the region progress socially and grow its economy, as we continue to provide opportunities for young and creative minds.”

In relation to revenue, the pandemic played a vital role in showcasing the importance of connectivity and a robust digital economy by increasing the demand for data consumption, hence increased revenue. But, mobile service providers also played an important role in countering the effects of the pandemic, which led to a decrease in revenue.

Despite the dip of revenue from USD44.3 billion in 2019 to USD43.9 billion in 2020, GSMA predicts a steady revenue increase in the Sub-Saharan Africa mobile economy.

In relation to this, Olatunji also elaborated how digital adoption will be effective in improving the mobile economy during the aftermath of the pandemic.

“This can be achieved by providing affordable technological solutions tailored to solve issues facing the Nigerians and Africa at large,” recommended Olatunji.

Company Profile

Company Profile Brand Identity Guidelines

Brand Identity Guidelines