Digital adoption is inevitable across all sectors. For any business to succeed and remain competitive today, it must embrace digital for better operational efficiency and customer service. Telecom companies are no exception.

5G networks may be facilitating a considerable number of digital transformations across multiple sectors but telecom companies themselves have to look beyond connectivity if they want to sustain or continue revenue growth. This means finding new revenue opportunities in applications, platforms, and services for incremental value.

What Are the Reasons for Seeking New Revenue Streams?

Despite the growing demand for better connectivity, telecom companies are not experiencing the kind of revenue growth they should be from digitalization. This is mainly because most are facing overcapacity and market disruption from other operators and digitally-enabled competitors like OTT service providers.

For example, over 70% of MNOs still rely on physical interactions – that is, stores and call centers – for selling their consumer packages. Unlike their digital content provider partners and competitors, telecom companies have been very poor at utilizing consumer behavior data for sales growth.

E-commerce for several industries has already identified that physical sales interactions are more costly, have lower success rates, and less accurate targeting than digital sales. Here are some cases for going digital.

- Since COVID-19 struck in 2020, consumers have been pushed towards e-commerce. While things have slowly returned to normal, many people will not go back to physical transactions like they did before the pandemic.

- For years, many businesses have been seeing great success in using a multi-channel approach to acquire sales such as SMS, email marketing, programmatic advertising, RCS, data rewards platforms, and even push notifications.

- Digital channels can support pro-active and customised campaigns through precision targeting with personalised offers.

- The consumer’s digital journey can be analysed and constantly improved with data analytics. For example, A/B testing for sales copy, form layouts, etc.

If telecom companies want to see greater revenue growth, ensuring high customer value and building a (separate) digital-native business unit need to be high on the agenda.

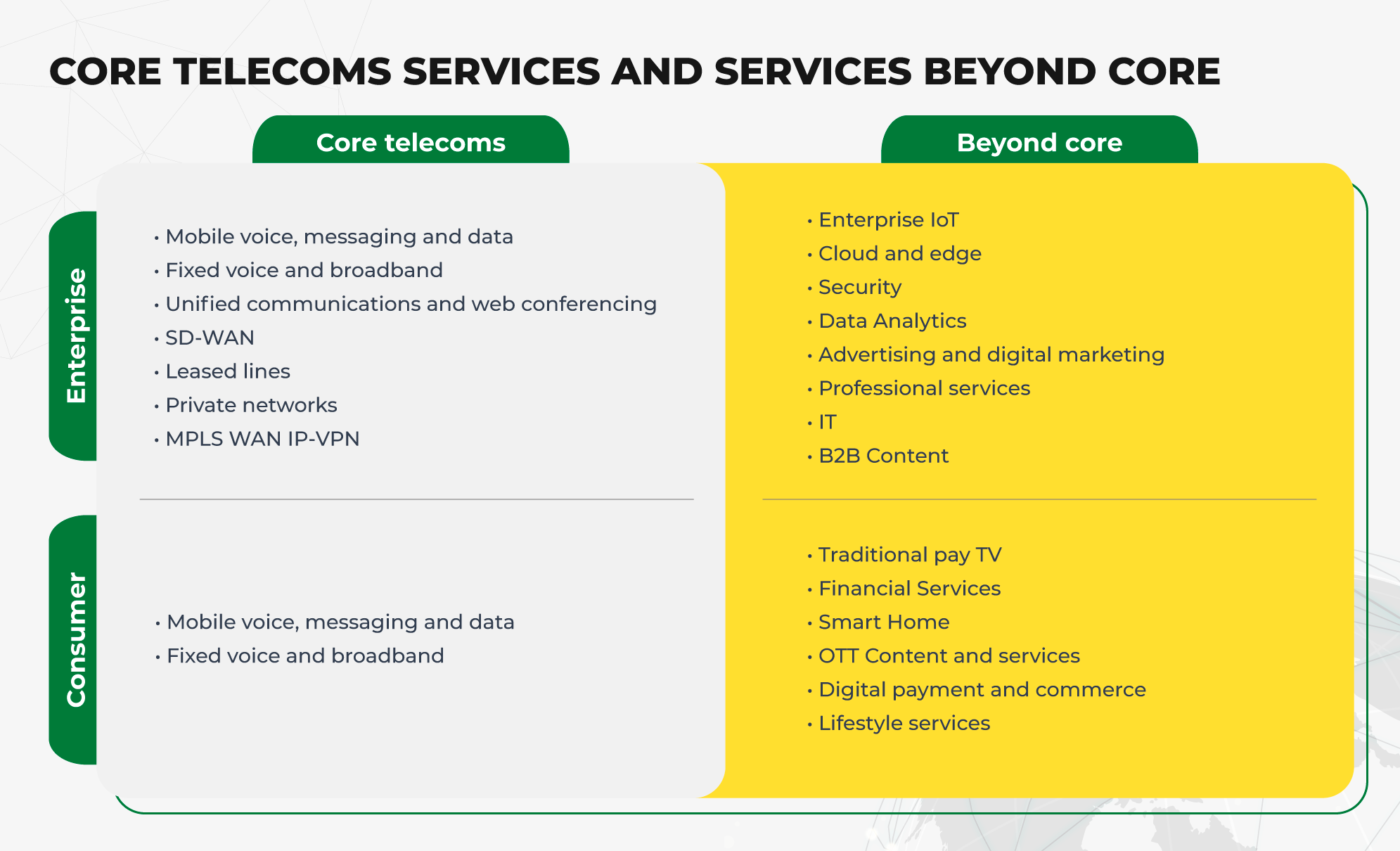

Thinking Beyond Core Products & Services

Today’s digital consumers have much higher expectations when it comes to product delivery, availability, and customer service. As there are more diverse options available now in the market, telecom operators cannot ensure that their core offerings are enough to satisfy consumers.

To retain their existing customers and attract new ones, telecom companies must go beyond core and tap into other verticals. According to McKinsey, a digital-native brand can contribute close to 25% of overall gross additional subscribers to the parent telecom company within 4 quarters from launch.

Related topic: How to Increase ARPU in Telecom for the 5G Era

Below are questions that operators should reflect upon when pursuing new, non-core revenue streams.

- Are my strategic objectives focused and reflected in clear milestones that can be measured over time?

- How do my strategic objectives fit in with my core telecoms strategy, knowing that there is some correlation between core and non-core revenues?

- As the services portfolio beyond core can be broad, do I have a system in place that allows me to assess success for individual services and understand what to focus on?

- As core and non-core services often have different requirements (e.g. marketing, sales), does my current organisational structure allow incremental value from services beyond core to be maximised?

- Is the allocation of resources and budgets between core and non-core fit for purpose, taking into account revenue growth and cash flow outlook?

- For complementary services (platform-based model or B2B packages), is my sales strategy leading with the most attractive service?

- Are my relevant stakeholders (e.g. shareholders, public investors, business partners) fully aware of my strategic objectives? Do I have a strategy for showing progress?

Recommendations for Telecom Companies

Telecom companies must identify key areas where digital investment is beneficial to staying ahead of the competition. Given the right resources at hand, some areas will be more apparent than others. Below are some useful priority quadrants to imagine this.

The 4 steps below will be critical for telecom companies to achieve that goal and tap into new revenue opportunities.

-

Offer a simplified and differentiated product

Today, telecom companies’ product portfolios have grown exceedingly complex over time and/or are too similar to one another. Most consumers are overwhelmed by just how many mobile plans are on offer in the market alone.

To appeal to a general audience, telecom companies should mimic digital service providers and make offerings less complicated. Provide transparent, easy-to-understand plans that can be easily changed according to the customer’s shifting needs.

Instant adaptability is a major reason why several popular platforms and services stand out. The development of a unified platform represents a great opportunity for telecom companies to streamline and deploy many of the services that they already offer.

Existing and new partners could also deliver their services directly to end-users by using a Digital Service Delivery Platform. Not only will this help telecom companies to continue driving demand (and revenue) for, and from, their core services, but it will also create traction for new, value-added services.

-

Implement technology that allows for flexibility and integration

For telecom companies to launch new features rapidly, a new IT stack may be required that is flexible, modular, and operates independently of the incumbent telco’s IT systems. Such IT stacks should leverage cloud-native deployments. With the advent of 5G, cloud-native architectures for telecom infrastructure will be needed to reduce operational overheads in the long term.

A microservices-based architecture is also another key component of these new IT stacks that simplifies the integration with front-end channels. Having microservices aids the implementation of customized user experiences for rewards, digital payments, subscription management, etc.

By implementing the right technology and adopting the best engineering practices (for example, business and operations support systems to maximize automation in the software development life cycle), telecom companies will benefit from a faster “build–measure–learn” loop. Thus, innovation and product-market fit can be achieved in record time.

-

Improve UI and UX through testing

After launch, an important thing to keep a close eye on is user experience (UX). Even if a telecom company does manage to streamline its services or evolve its offerings, it does not matter if the UX is not equally cared for.

Bad UX will impact a product’s value in customers’ eyes. For the best results, telecom companies should design end-to-end customer journeys that are 100% within an app, from onboarding to support. For example, letting customers upgrade or downgrade their data plans in real time and easily purchase (and immediately use) additional data.

If it is a platform, it should have a seamless, intuitive interface with simple wording. Product designers must work closely with customer feedback to create and test the user interfaces (UI) and UX every step of the way. When customers end up having fewer questions, the cost to serve drops significantly.

-

Use advanced analytics to drive digital sales

Today, successful digital sales acquisition often requires continuous reinvention to maintain loyalty and tap into new pools of subscribers. Telecom companies have to adopt new channels, formats, and even creatives if they want to achieve a much faster time to market.

Compared to digital companies, which push out their new promotions and campaigns in a few days on a very short idea-to-execution cycle, most telecom companies take several weeks to do so. This gap is because of advanced analytics that helps digital companies to personalize offers based on a customer’s preference.

Telecom companies should consider leveraging marketing tools from outside the industry to build marketing technology stacks that rapidly implement such personalization strategies through all channels. By embedding partners such as marketing agencies much deeper into daily operations, promotions and sales can be optimised.

How Forest Interactive Helps Telecom Companies Increase Revenue

The global gaming community is an important market to tap into and provide inclusive opportunities for consumers to get the most out of their mobile experience. By using a fully functional platform such as DVP, telecom companies can save their costs from investing in new, untested platforms.

The underlying digital platform technology of DVP is backed with 15 years of in-depth experience in providing scalable mobile platforms to over 90+ mobile operators and 150+ content providers worldwide. Connected to more than 1.4 billion subscribers, over 450 servers on the cloud across multiple continents are constantly monitored to ensure uninterrupted services for transactions.

Related topic: Forest Interactive Cambodia Teams Up with Cellcard to Boost Development of the Country’s Gaming Community